South Africa’s financial watchdog has announced that it is investigating online trading brokerage Banxso after scores of people allegedly lost millions of rands after sinking their pensions and life savings into the scheme.

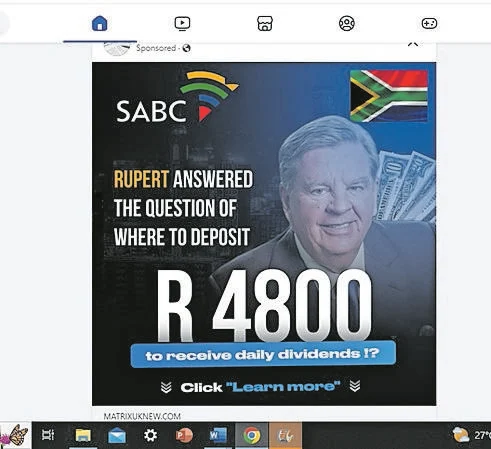

The investors allege that Banxso consultants contacted them after they clicked on deepfake adverts featuring prominent business people such as Elon Musk, Johan Rupert and Nikky Oppenheimer, offering excellent returns for a minimum investment of R4 800. People then invested using an online trading platform allegedly on the trading advice of Banxso’s “success managers”.

Banxso chief operating officer Manuel de Andrade has denied that the company has any links to the deepfake adverts that were created by Immediate Matrix, a company that the Financial Sector Conduct Authority (FSCA) in December last year warned consumers to steer clear of.

On Friday, the FSCA said in a statement “that it is investigating possible contraventions of financial sector laws by Banxso”.

“The investigation follows several complaints received by the FSCA in relation to the conduct of Banxso and is of the opinion that the allegations should be investigated. The FSCA emphasises that the investigation is not completed and that it has made no findings to date,” the FSCA said.

The statement added that Banxso is cooperating with the investigation.

The FSCA has called for members of the public or investors who have any information regarding the matter to contact the FSCA by sending an email to Enforcement-Complaints@fsca.co.za with the subject: Banxso Investor.

It warned investors to check whether an entity or individual is authorised to provide a specific financial product, financial service or financial advice by contacting the FSCA and by conducting an online search for authorised financial institutions by licence and product category by searching its website.

De Andrade said in a statement that the company welcomed the investigation.

“Banxso has been cooperating with the FSCA since 09 February 2024 and will continue to offer the authority our full cooperation. We act in an open, honest, and transparent manner in all of our dealings and we are confident that the investigation will clear our name,” De Andrade said.

“In its press release, the FSCA confirms that we have been offering our full cooperation and that there has been no finding made to date. A major part of the process has been the cyber investigation conducted to prove that Banxso is in no way connected to Immediate Matrix, and we look forward to this emerging when the findings are released.”

He said Banxso is registered and complies with all regulatory requirements.

The watchdog confirmed that the company is authorised by the FSCA as a category I financial services provider with FSP number 37699.

Investors who lost money on the online trading platform and are still struggling to obtain refunds from Banxso expressed mixed reactions to the announcement of the investigation.

Investor Darron Tarr said the announcement of the investigation and its parameters was “very vague”.

“It raises two questions in my mind. What are the financial sector laws to which they refer? Does misleading advertising fall within the purview of these financial laws? I certainly hope so because in my opinion that is the most egregious form of misconduct,” he said.

He alleged that Banxso had “unashamedly” marketed its services based on “a false premise and they continue to do so with impunity”.

Carl Boonzaaier, who lost R828 000 of his pension savings on the trading platform and came close to sinking further funds into the scheme, said he is still chasing a refund.

“I have sent a letter to Manuel de Andrade on 4 April to refund me my money. Two days later I received an acknowledgement of receipt of my letter. Since then … no communication from him/them at all,” Boonzaaier said.

An investor who asked to remain anonymous said she had lost R904 800 on the trading platform and had since been advised by Banxso that investing in the scheme “can lead to a total loss of funds”.

“They do not take any responsibility for my loss but draw my attention to the fact that investing with Banxso can lead to a total loss of funds. No retirement savings or emergency funds should be used. This is in total contradiction of what my success manager said emphatically,” she said.

She said if Banxso was cooperating and “showing willingness to refund losses to devastated pensioners” there should be more transparency on the guidance and training of its “success managers”.

“There are huge contradictions. When I questioned the written warning [about potential losses] on the Banxso agreements, my success manager laughed them off as not to worry about the small print as ‘we have stop losses and only trade with small percentage of your funds. The other funds are protected.’ It would help to get some answers on why their success managers operate the way they do,” she said.

Another investor who also asked to remain anonymous said former and current Banxso employees should provide the FSCA with information.

“I just really hope and pray that the FSCA’s publication prompts people who are working, or previously worked, for Banxso, and who want to expose Banxso, to come forward to the FSCA as whistleblowers. Those whistleblowers have to approach the FSCA voluntarily as there is no way the FSCA could otherwise know what is going on at Banxso,” she said.

Leave a Reply